Real Estate What Can I Afford Spreadsheet Google Sheets

Real Estate

Listed in this category are financial model templates for existent manor businesses and its related sectors. The models are great tools for conducting valuation to those who plan to invest or purchase properties, developers, and other users that involves real estate.

Real Estate Manufacture - Real Estate Financial Modeling

The real estate industry is 1 of the biggest industries that is continuously growing. Generating billions of dollars in revenue every yr, even though in that location were times where the economy in real manor fluctuates, information technology is all the same undeniable that this manufacture is offering a lot of opportunities for startups to plow a profit. This is due to its fast accommodation of huge economical trends that affects real manor businesses greatly such as interest rates, population growth, and economical strength.

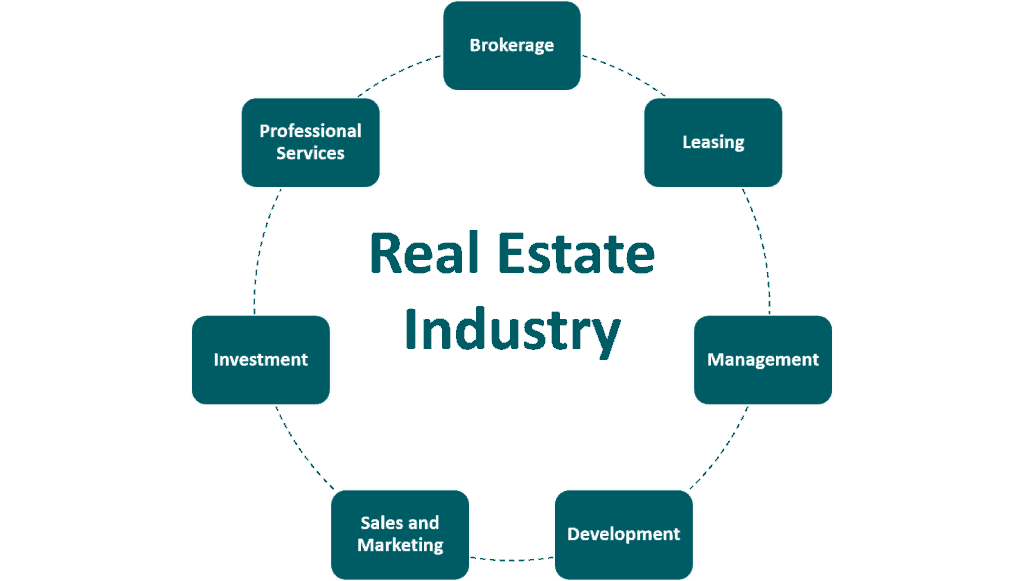

The real manor manufacture, as we know, consists of various fields such as the following:

- Real Estate Brokers (for Buying and Selling Real Manor) - Working in this field which is also called real estate brokering, focuses on convening buyers and sellers of properties as well as profitable in negotiations for pricing, and facilitating the tasks involved in closing deals towards interested parties. They also offering services such every bit property appraising and inspecting. The usually earn their go along through commissions based on the agreed percentage of the sale price, split up betwixt the buyer'due south broker and the seller's broker. This is why brokers earn more coin when closing a college-priced bargain since they get a higher cutting. Also, to be a banker, one must get a license in the area they work.

- Charter Brokers - Unlike from brokers that usually work for either the heir-apparent or seller of properties, leasing agents piece of work straight with property owners. They bargain with all the complexities involved with canvassing, investigating, and signing prospective tenants of the owner'southward properties. This as well includes all the paperwork needed to be washed.

- Real Estate Management - In this field of existent estate are management companies that operate with bigger properties such as buildings. Their tasks are ensuring that the buildings are running properly, check if the utility expenses are paid, the hiring of staffs, and also performing the maintenance. Sometimes, these companies besides act as leasing agents. Management companies' profitability depends on their ability to maintain low vacancy rates since near property expenses are fixed anyway.

- Developers – Earns profit by adding value to the land such every bit creating a building, rezoning, building improvements, etc. while also shouldering the toll for the said projects. Developers usually purchase a raw land then either they rezone, construct new buildings, and renovate the existing buildings so that they can sell or lease the concluding product to the market. Basically, existent estate developers are people and companies that coordinated such activities to covert a raw land into something more of a marketable and more appealing holding.

- Sales and Marketing - Commonly works paw in hand with developers to marketplace their finished products, such equally for selling condos, townhouses, apartments, etc. People working in this field are oft called real manor sales agents who exercise all the marketing and selling, in exchange for some committee.

- Investors – Entities such as entrepreneurs, executives, companies/business enthusiasts, banks, etc., who are interested in venturing in the real estate manufacture. Most often they look for potentially assisting ventures and provide funding. At that place are different types of real manor investors such every bit:

- Institutional – an arrangement that invests on behalf of its members east.yard. banks, insurance companies, pensions, REITs, endowments, mutual funds, etc.

- Funds – an open-ended investment visitor or entity that pools investors' money into a fund operated by an assigned manager which uses the pooled money to invest in various ventures.

- Private – an entity that invests their coin with the goal of providing help and getting a return on their investment eastward.g. family and friends, angel investors, venture capitalists, individual equity firms, etc.

- Corporate – is basically a visitor that invests in other companies with the hopes of taking control or taking over the visitor itself.

- Etc.

- Professional Services – Equanimous of real estate professionals who work for many dissimilar cases in the existent estate manufacture such every bit valuing properties, appraising assets/backdrop, agents, inspectors, lawyers, accountants, contractors, construction workers, tradespeople, etc.

It is quite common in the real estate industry to practice intermediary to provide real manor owners with a dedicated sales and marketing back up in exchange for commissions. Therefore, it became the principal reason for the development of different fields in the industry.

Types of Existent Estate Business organisation

When you hear real estate, what's the first matter that comes into your heed? Isn't information technology property, land, buildings, etc.? The term was actually derived from the Latin word of real which is rex. It means "imperial" since it is known that kings own all land in a kingdom. The real estate industry is very huge not just in terms of lands and properties but also financially. Thus, it is no wonder there are many entrepreneurs, investors, property owners, wants to start a concern in existent manor.

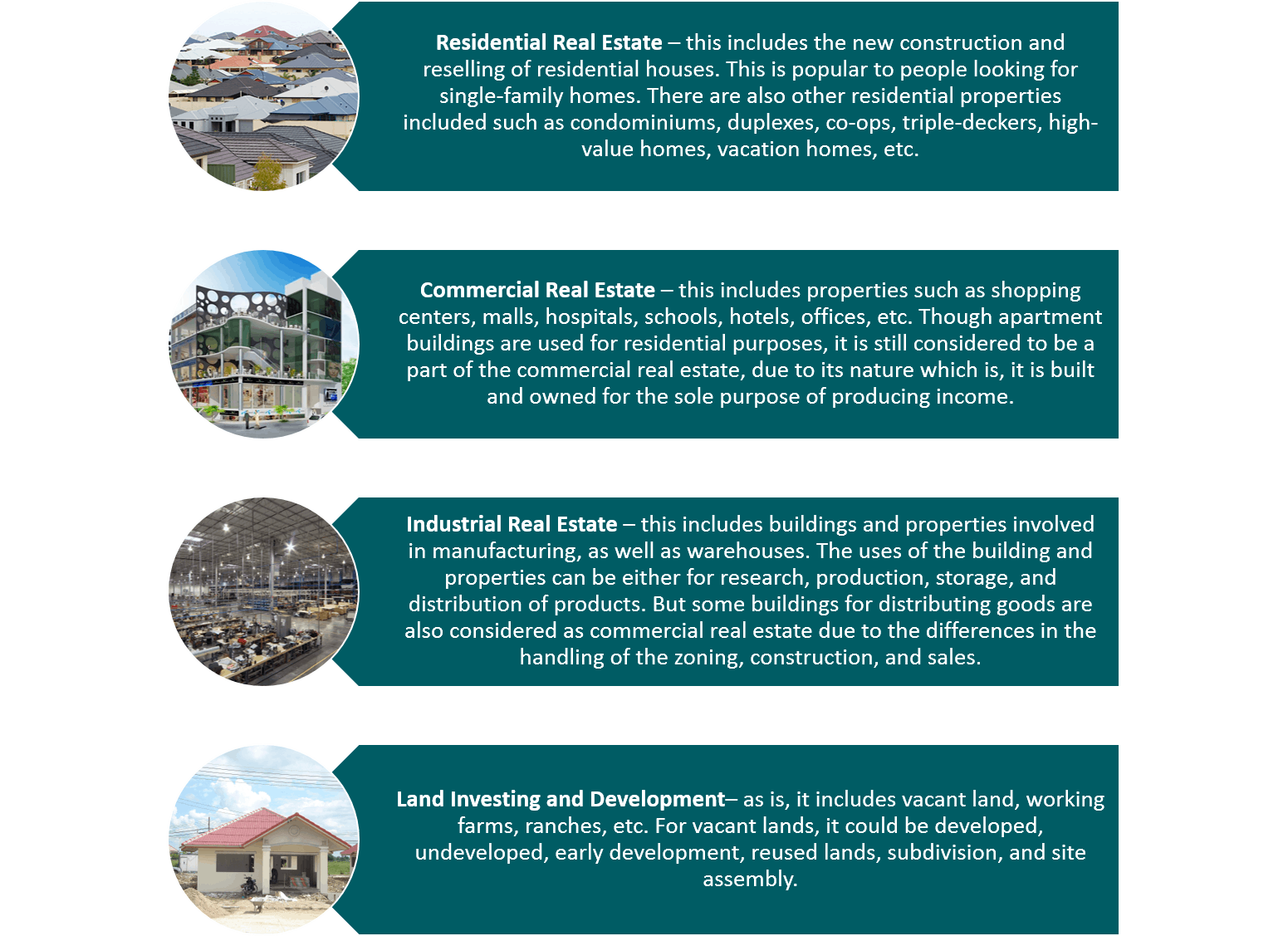

There are four types of real manor that are commonly known nowadays:

Nowadays, real estate businesses comprehend non only i blazon of real estate merely also combinations of dissimilar types of real manor. Thus, giving them more coverage of the potential market in the manufacture.

Investing in Real Manor

Equally simple equally ownership or selling existent manor properties are already considered every bit investing in existent estate. Thus, this entails that there are many factors that you need to consider. Volition the house value increase while currently staying in it? Will the future involvement rates and taxes affect y'all if you get a mortgage? There are different ways of investing in real estates, such equally real manor flipping, commercial real manor investment, real estate investment trusts, market listings, public auction, private sales, etc.

Real Manor Flipping

It actually varies on an individual on how skillful they are with handling real estate deals, that in the end, they'll stop upwardly starting a business with information technology. This is what we call house flipping. Information technology'due south when you buy a unproblematic firm, amend it to arrive more than valuable and attractive, and so you sell information technology back to the market place for a better and college price. Real estate flipping is ideal for getting a quick profit rather than holding on for a long-term deal. It is oft used to describe short-term real estate transactions equally well equally to describe purchases in initial public offerings (IPO).

Real Manor Development

In some cases, some accept reward of the opportunity by farther developing their properties to earn more profit. Real estate development or property evolution covers activities such every bit:

- Purchase raw land or properties to beginning a projection with

- Finance real estate deals that are potentially profitable

- Manage the process of development from the start till the end (plan, design, lead, etc.)

- Develop new projects from scratch (unlike from flipping since it is taking something which already exists).

- Small or big-calibration developments especially in fast-growing places like Dubai, real estate developers like Emaar have developed large calibration projects nearly in the middle of the desert and turned them into skyscraper cities (E.g. Dubai Marina). They also adult large calibration residential housing projects (e.k. the Palm Islands Dubai)

Most often, existent manor developers take a huge hazard in the building and renovating of existent manor projects just this likewise allows them to reap corking returns. Hence, the ascension of real estate development became a field which is very popular in the real manor manufacture.

Commercial Existent Estate Investment

Another manner is when you ain several properties, then you end up renting/leasing them out. It is very convenient and helpful for you when y'all are tight with expenses and handling many backdrop on hand that is not being used. And then, might as well earn some extra cash out of it. In some cases, people transform their homes into Airbnb types, equally a convenient way to rent out all the rooms available, while others turn their vacation homes into vacation rentals by owner (VRBO)or Home Away.

In some cases where it involves properties that are solely meant for commercial purposes then investors earn past leasing holding so charging the tenants rent in substitution for using the property and also by taking advantage of the value of property over time. This is chosen commercial real estate investment.

REITS

For those who don't own any property for housing or building, there are also other options for you to invest in real estate. There are stocks offered that are available to the market from homebuilders. Though it's a bit risky due to the stock prices fluctuating prices in the market. Last but non the least choice is more than common which is called the real estate investment trusts or REITS. This is when you invest in commercial real estates, which works just like buying stocks in the residential real estate just its prices are more than backside the trends by a few years.

REITS works similar individual disinterestedness firms, but for properties rather than companies. Raising coin from investors and then acquire properties by combining debt and equity, they and so operate and improve the properties over time, and and so eventually sell them for a better cost. REITS can be divided depending on the type of property they focus on such as residential, hotels, function, storage, and and so on.

Merely of grade, earlier you beginning venturing in these kinds of businesses, you must ensure that y'all will be able to go the best out of information technology. Written report the market but conducting enquiry assay and as well make certain that y'all know the current business cycle of the existent manor industry. Yous don't really desire to showtime investing in existent manor when the market is about to crash. And so, exist smart and supplement your know-how in the real estate industry.

Real Manor Industry Risks

With how much the real estate industry earns annually, information technology is no wonder that many entrepreneurs, venture capitalists, and other investors, are interested in starting a business organisation in the existent estate industry. But, just similar in any industry, 1 must be aware of the risks that y'all volition have to face.

The following are a few of the common risks in the real manor manufacture:

- Macroeconomic Factors – this adventure is beyond the command of the business organisation owner since it has to practice with the local or national economic system such as natural disasters, market turn down, economical downturn, etc.

- Changing Demand – location, location, location… this is what they all say that matters the most when working in a existent estate business. Location matters a lot then, when at that place are changes in the need from the market, some properties become less desirable. But this also goes the aforementioned for in times when you predict the areas which will give yous a lot of benefit in the hereafter. Basically, the changes in need can be a good or bad factor that will affect real estate businesses.

- Increased Supply – seeing how great the real estate business is doing in the market, many wants to accept a go in this industry too, hence there are many new building properties bachelor for sale in an area. But, this tin actually drive the rent and prices of properties to become downwards due to the overwhelming number of supply available.

- Tenant Destruction of belongings – in some cases, some tenants tend to destroy properties randomly. Hence, the need to screen the potential tenants carefully is critical just then again, it'due south not always full-proofed and constructive since there are cases that couldn't be helped such equally accidents, burglary, purposeful destruction of holding, etc.

- Interest Rates – information technology is but obvious that if the interest rate rises, the value of the properties normally come down due to college cap rates. As it is, involvement rates are important factors in the evaluation and functioning of any investment due to the impact it causes to the nowadays value of future cash flows. The increase in interest rates is often caused by aggrandizement, bond supply, and demand, etc.

- New Laws - especially new clearing laws which tin lead to more demand among foreigners to rent properties every bit they come to work, every bit a effect, there are certain revenue enhancement laws that affect the rental existent manor owners.

- Government – the changes in the government affects pretty much every industry, especially the state of affairs of the economy. Some furnishings might exist minimal but most often, an outcome is still an issue which the small-scale-fourth dimension owners in existent estate might not be able to shoulder.

- Changes in Priorities and Requirements – this mostly applies to buildings under direction companies that are aging. As fourth dimension passes by, the properties will slowly deteriorate, so there will be changes to ensure the life duration of properties. Eastward.grand. indoor air quality, mold removal, etc.

These are just a few out of all the existing risks in a real estate business organization, merely this doesn't hateful that it's a bad thought to invest in existent manor. Y'all volition do simply fine, as long every bit you do certain preparations such equally building a financial model.

Real Estate Financial Modeling

Real estate fiscal modeling became a sought-after skill for businesses and career involving existent estate. Learning real estate financial modeling enables ane to build fiscal models for the acquisition, financing, and development of existent estate properties equally to conduct analysis beyond assets, capital letter structures, investment returns, valuation, and other factors which could help the user with a profitable venture.

The post-obit are some of the things needed in real manor financial modeling:

- Build a functional and dynamic real estate financial model from scratch

- Model existent estate transactions for different types of existent estate as well equally summate the cardinal metrics and fiscal ratios

- Bear an analysis by considering unlike scenarios and simulations co-ordinate to trends

- Real estate industry and fiscal modeling know-how

Without the proper know-how, of form, it is only natural that real estate financial modeling is a time-consuming and a complex task that not just anyone can do. Hence, the need for assistance from professionals in financial modeling is critical for those who want to plough a profit in real estate business or career.

Best Computational Assistance for you lot as a Existent Estate investor

Are you a real estate investor, e'er on the lookout for deals that can help in getting bonny returns on your investment? If yes, then yous surely come beyond propositions that are confusing and where you cannot easily decide whether to put in your money or not. This is a problem encountered by many investors like you. Experienced investors have a lot of data and data to fall back upon while relatively inexperienced investors must take a decision based upon their gut feeling. However, in this age of science and technology, you need not accept a risk involving hundreds of thousands of dollars anymore. We, eFinancialModels, bring to yous the power of our real estate fiscal models.

We have the best Existent Estate Financial Modeling Excel Templates

Y'all must accept heard about real estate financial model xls templates. These templates are a treasure house of knowledge for all real estate investors. They combine the principles of finance and real estate in such a manner to make the financial picture much clearer for the investor. This makes it easier for readers/users to take a decision before signing off on a deal. By using a solid and working financial model framework, yous will know amend whether the deal is going to exist profitable or not. All yous take to do is to update the templates with figures applicative to your specific investment case and run the model to know what the returns on your investment would exist.

No need to be the finance expert

The best matter with real estate fiscal model xls templates is that you lot need not be a fiscal skillful to understand the nuances of your investment. No worries if y'all do not have a sound understanding of the principles of finance. Our experts have everything worked out for y'all by applying their know-how to the fiscal model. Plus, near of our models are in Excel so y'all can see the calculations and how the results were calculated/arrived. Do you want to know the present value of greenbacks flows in the project you are interested in? The real estate fiscal model will help you in knowing a correct approximate of the future greenbacks flows. Isn't that great for y'all as an investor?

Utilize our templates to help calculate financial feasibility

Imagine a situation where you have fallen in dear with an apartment edifice and also with the asking price demanded past the owner. You are ready to arrange the money to buy the building equally a existent estate concern potential without ascertaining the time to come cash flows the building would be able to generate. This is zippo but taking a huge risk as an investor. Thankfully, yous can now have reliable assist in the form of real estate financial modeling Excel templates. These financial templates cover every aspect of a existent estate transaction such as valuation, financial projection, adding of fundamental financial ratios, etc. Existent estate transactions could range from residential land purchase, real manor evolution to commercial real estate valuation and investment, to which a existent estate financial model xls tin can help make up one's mind the profitability and risks for such ventures.

A existent manor financial modeling Excel template that fits your projection

We accept you covered whether yous are planning to buy an apartment circuitous or real estate that you plan to buy and develop. Of course, to make certain whatever investor or user can empathise and use them, we practiced edifice our real manor fiscal models to exist simpler and less complex. However, it is expected that any investor trying to piece of work out the profitability of a real estate project has a basic understanding of finance related concepts such as LTV (loan to value ratio), GOI (gross operating income), NOI (net operating income), DCR (debt coverage ratio), CCR (weather condition, covenants, and restrictions), and and so on. If you take basic cognition of finance related concepts used in real estate transactions, you can easily use our financial templates to take a articulate flick of the profitability of a project.

Call back, it is your hard-earned money that is at stake. Do not accept a decision in haste. Endeavour our real estate financial modeling Excel template to get a clear understanding of the profitability of a projection before taking a determination to invest.

Nosotros e'er strive to create our financial model templates to yield the most authentic results as we offer our assistance to people in demand of our financial modeling expertise and know-how all over the globe such as in the U.s., Great britain, Canada, Australia, Japan, and many more countries.

Need guidance on how to build your own financial models but can't afford to hire an practiced to help with your fiscal modeling tasks? Then why not do information technology yourself and save your coin from loftier professional fees by learning financial modeling today!

Source: https://www.efinancialmodels.com/downloads/category/financial-model/real-estate/

0 Response to "Real Estate What Can I Afford Spreadsheet Google Sheets"

Post a Comment